Table of Content

We can approve your home equity loan in as little as 1 Hour and can get you the funding you need immediately. So if you have a poor credit score then you should first concentrate on improving your credit score to at least above 750 mark and then should you apply for home loan. EMI stands for Equated Monthly Instalment that you need to pay each month to the lender against home loan availed from it. Calculation of EMI is based upon the pricipal, interest rate and the loan tenure. In today's world, a lot of young people dream of owning a house but find it difficult to turn their dream into reality as their personal resources don't allow them to do so. Buying a home seems to be one of the challenging tasks as a large amount of fund is required.

A promissory note sets the terms of the mortgage, including interest rates and how long the borrower has to repay. The mortgage is used as collateral to protect the lender’s interests – should the borrower fail to pay, the lender has the right to take over the property. If you’re struggling to fund your business ventures or dream of home ownership through the bank, you might consider a private mortgage instead. Private loans have much more relaxed guidelines, allowing us to qualify borrowers who may not have qualified for other traditional loans in the past.

What Is A Private Mortgage?

In your secure online account, you can easily upload your required personal, property and mortgage documents to get approved faster than traditional brokers. This goes on until at the end of the loan, the principal repayments are almost 100% of the monthly annuity. In other words, your savings component increases, month by month, year by year. Nevertheless, our mortgage calculator is a good start in your search for the best mortgage.

The Letter of Offer shall contain such terms and conditions as UOB may require in relation to each property loan. If you'd still like to pursue a loan from a traditional lender, you can always start the approval process to see what kind of rate you might qualify for and what your mortgage details might look like. Borrowing from a friend of family member might seem like a good idea at first.

Competitive jumbo financing options

Your future investor is looking for a borrower they can rely on to pay off their loan on time. Before you make any major financial decision, it’s important to do your research and understand what risks are involved. Private mortgage loans can be highly advantageous, but they certainly aren’t for everyone in every situation. Private mortgage insurance is typically required when the buyer has less than 20% equity in the home. It's ultimately up to the lender as to whether they want to impose insurance requirements.

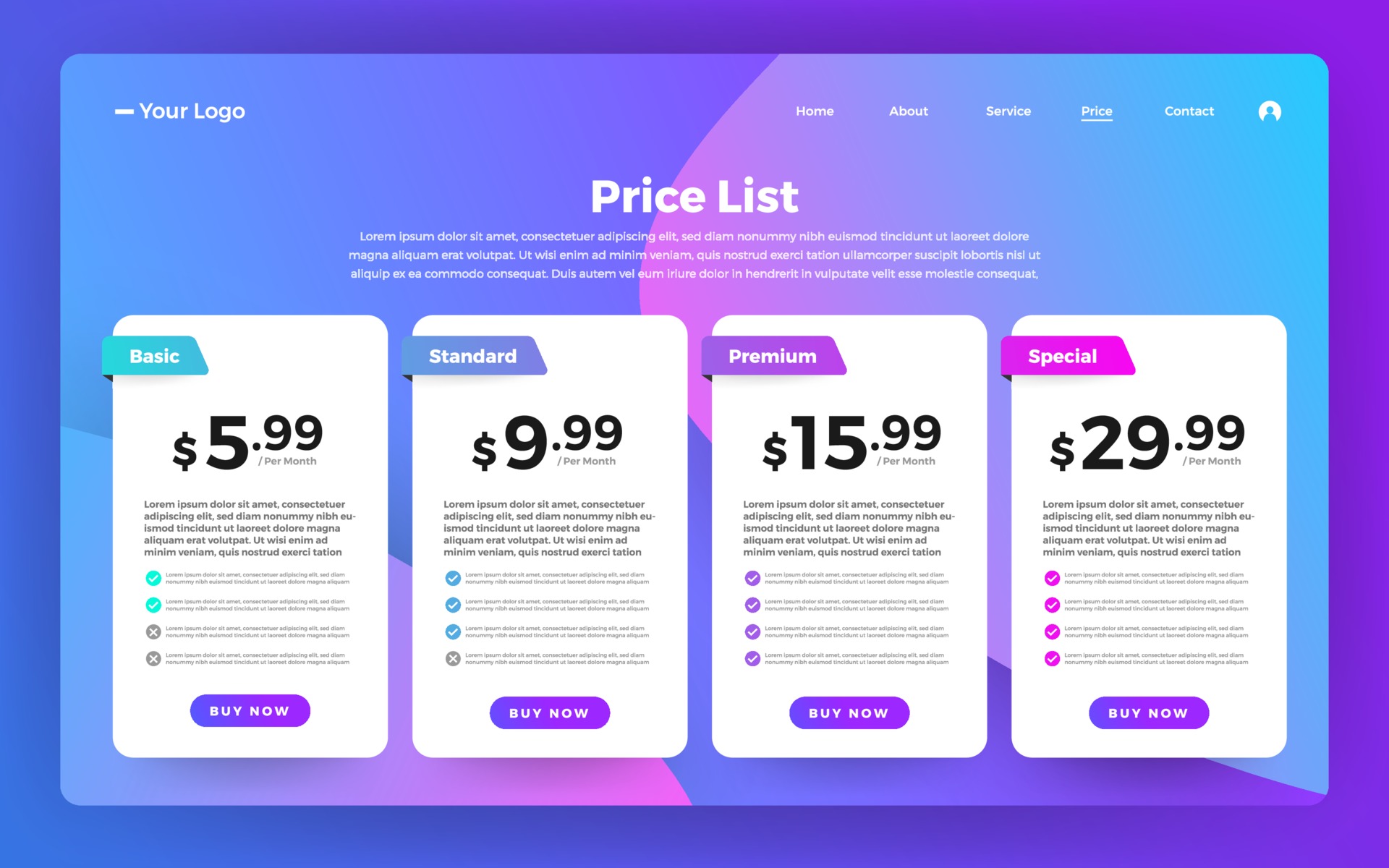

Sign Up Gifts are on a first-come-first-served basis, whilst stocks last and subject to availability. UOB shall not be required to notify and/or update on the stock availability. Choose from a range of competitive pricing packages with support from our dedicated mortgage bankers. ~Applicable for a limited time only, promotion ends 30 December 2022.

Who is Private Lending For?

Refinance your existing home in Germany to lower interest rates or cash out on your home equity. For nonconforming loans, application must be submitted within 90 days of purchase. For conforming loans, application must be submitted within 6 months of purchase.

The monthly repayment rate comes from the loan amount, the annual interest rate, and the annual repayment rate. After entering this data into the German mortgage calculator, we calculate the estimated loan amount, interest rate, and monthly repayment rate. To calculate your mortgage, we need some basic information such as your age, the property price, the location of the property, your amount of savings, the annual repayment rate, and information about the real estate commission. First of all, you must analyse your income and expenditures and then come to a loan figure, whose EMI you can afford to pay per month. You can also negotiate on interest rate and other terms of lending bank, if you are its old customer & hold a decent credit score.

How home equity loans can affect PMI

Aside from the real estate agent fees, additional purchase costs are usually paid only by the buyer. Our German mortgage calculator lists all additional purchase costs. This depends on several factors, such as the amount of the mortgage and how much you want to pay back monthly. The rule of thumb is that the monthly mortgage payment should not exceed 40% of your net income. Under certain conditions, it is also possible to finance a property without equity.

This is why they are able to help borrowers ONE DAY out of a major credit event as low as a 500 FICO. Professional help at the outset will ensure your private mortgage arrangement continues to benefit both parties for the life of the loan. Tax laws are tricky, and moving large sums of money around can create problems. Before you do anything, speak with a local tax adviser so you’re not caught by surprise. Similarly, people with extra cash on hand can earn more by lending privately than they’d get from bank deposits such as CDs and savings accounts.

The cost of your private mortgage insurance can be eliminated with enough home equity. Federal Housing Administration insures mortgage loans made by private lending institutions to finance the purchase of a new or used manufactured home. Valuation subsidy is subject to clawback if the loan is repaid in full within 3 years from 1st loan disbursement date.

There isn't a specific government agency that oversees private entities that act as lenders. If you have a legal issue, you will need to consult an attorney to discuss your situation and options. Just as the borrower's financial situation may change, so can the lender's. Evaluate the lender’s ability to take on the risk of a large loan before moving forward.

Federal Housing Administration insures mortgage loans made by FHA-approved lenders to buyers of manufactured homes and the lots on which to place them. Prior to the approval of your home loan application, we will appoint a valuer to assess the market value of the property. If thisvaluationis lower than your purchase price, you would have to pay the difference in cash before any loan can be disbursed. Submit your loan application online now and our banker will be in touch with you to share more about exclusive home loan rates and promotions available. It’s important to remember that a loan is a business transaction, whether you know the person or not. That means once you accept a loan from a family member or friend, they also become your lender, with a lien on your home.

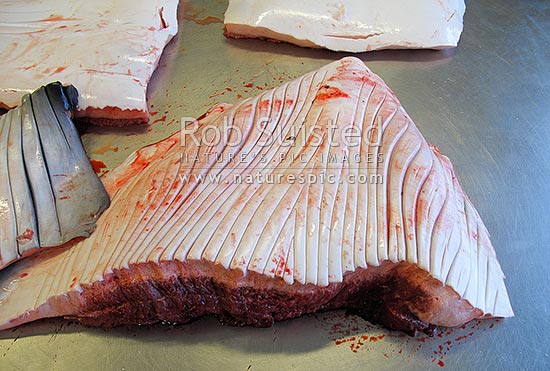

However, inspections and appraisals are vital to ensuring the house is in good physical condition and is a good investment. A private portfolio loan has several uses and can help a variety of different borrowers. They are ideal for self-employed borrowers who show their income in nontraditional ways; or if you have had a serious credit event such as a Foreclosure, Bankruptcy, or Short Sale. They can help you as soon as ONE day after that event, and they can even help borrowers with FICO’s as low as 500! Private Portfolio loans do not have loan limit regulations such as Conventional or FHA loans, which allow borrowers to purchase or refinance super jumbo loans.